Filing a monthly report and paying amounts due

Employers and independent contractors operating on construction sites subject to the Act respecting labour relations, vocational training and workforce management in the construction industry (Act R-20) must file a monthly report with the CCQ, even when no work has been carried out by the independent contractors, the employers themselves or their employees. The report contains information relating to workers hired and hours of work per sector of activity, etc. The monthly report must be accompanied by a payment corresponding to the remittances and contributions stipulated in the collective agreements and Act R-20.

A monthly report must include, among other things:

- Identification of the employees.

- Their trade or occupation.

- The sector and wage schedule where the work was carried out.

- Hours worked.

- Wages paid.

Independent contractors must provide this information for the hours they themselves have worked.

Employers must also forward the various remittances specified in the collective agreements and regulations, including union dues, insurance premiums, pension contributions and annual vacation and sick leave allowances, etc.

Download the CCQ calendar for the monthly report periods and the annual vacation periods stipulated in the collective agreements.

To lighten the administrative burden on construction companies and help them meet their obligations more easily, the CCQ allows them to fill out their monthly report in different modes, whether by internet, mail or telephone, and to make their payment for all remittances accompanying a monthly report by preauthorized payment, electronic payment or cheque.

Transmettre un rapport mensuel et payer les sommes dues

This document is your reference for completing the employer’s monthly report. It contains a wealth of information, including:

Transmettre un rapport mensuel et payer les sommes dues

-

Filing Methods

To make it quicker and easier for employers to fulfill this obligation and help them avoid making mistakes, the CCQ offers them the option of filing their reports with our online services using accounting software or an online form, or filing their reports by telephone. Employers may also choose to complete their report in paper form and send it by mail.

Remittances must be paid no later than the 15th of each month following the period covered, by preauthorized payment, electronic payment through a financial institution, or by cheque.

Online services

Click here to access online services

Adapted to both large and small companies, the CCQ offers employers two ways to file their monthly reports online in a completely secure way, 24 hours a day, 7 days a week, and free of charge. These online services are offered in a protected, secure mode, whereby an employer uses accounting software or fills out the report directly online.

Using accounting software

A number of accounting software packages allow for the automatic creation of an electronic file containing all the necessary data. The Transmission of monthly report service is simple to use and transmits the report in a just few seconds.

Completing the form online

The Monthly report data entry form is particularly well adapted to small companies that do not use accounting software. This electronic version of the paper form now offers 199 lines of detail. This service reduces the risk of error by calculating and validating all data entered by the employer. Some information even appears automatically on screen and filling out the form has never been faster.

The CCQ offers assistance to employers wishing to file their report electronically. Employers can contact the CCQ for assistance by writing to [email protected].

By telephone

Filing the monthly report by telephone is meant for companies that do not yet have access to our online form or to an adapted accounting software package and that report hours for 10 employees or fewer per month.

This service allows employers to submit the basic data needed for the production of their monthly report by voice on the phone. CCQ personnel will then inform the employer of the required remittance amount. Subsequently, the employer receives a copy of the monthly report by mail or fax.

The telephone service for filing employers’ monthly reports is offered Monday to Friday, 8:30 a.m. to 4:30 p.m. on the five working days preceding the end of the period.

- To file monthly report by telephone (in the Montreal region): 514 798-0908

- To file monthly report by telephone (outside Montreal): 1 888 798-0908

2025 Schedule – Filing Monthly Report by Telephone

January:

8 to 14 July:

8 to 14

February: 10 to 14 August:

8 to 14

March:

10 to 14 September:

8 to 12

April:

8 to 14

October:

7 to 14

May:

8 to 14 November: 10 to 14

June:

9 to 13

December: 8 to 12 By mail

The monthly report may also be sent through the mail by filling out the Employer’s monthly report form supplied by the CCQ. Employers must calculate their remittances and consult the wage rates updates and any other information needed to do their report.

Click here to download the Reference Guide for Completing the Employer’s Monthly Report.

-

Payment Methods

The monthly report must be filed and the total remittance paid no later than the 15th of the month following the period covered. Payment methods available are:

- Preauthorized debit: this payment method is used only by employers who file their monthly report electronically or by telephone. To sign up, use this form.

- Electronic payment: Employers can pay their remittances through the website of their financial institution.

- Cash payment or debit card: this payment method is accepted only at the customer service counter.

- Payment be personal or certified cheque or money order: Write your employer number on the cheque or money order and forward it to:

Commission de la construction du Québec

Case postale 2000, succursale Chabanel

Montréal (Québec) H2N 0B7

Penalties in case of late payment

An employer who submits a monthly report and the related payment after the deadline set under the Regulation respecting the register, monthly report, notices from employers and the designation of a representative (R-20, r.11) may be liable to penalties with interest.

Penalties and interest are established in accordance with Section 81 c) of Act R-20, based on insurance premium, pension contribution and paid vacation amounts. Interest is 7% annually and the penalty 20%.

When an employer fails to pay an amount due within 10 days of receipt of a late payment notice, the CCQ initiates other procedures and may refer the case to its attorneys.

When an employer believes that there were exceptional circumstances preventing it from submitting its monthly report and related payment within the required deadline, the employer can complete a form or write to the following address: [email protected].

-

Request for correction of monthly report

If an employer notes an error in a monthly report after it is submitted, the employer must send an amended monthly report to the CCQ, by email via its online services, by fax, by mail, or by bringing it directly to one of our regional offices.

Withdrawal or reduction of hours

When the revision concerns a withdrawal or reduction of hours declared, the employer must attach the form Demande de retrait ou de réduction des heures déclarées au rapport mensuel to its amended monthly report. The form must be signed by the employee concerned in the request so that he or she authorizes the CCQ to withdraw or reduce the number of hours in his or her file.

Receipt of this form, duly signed, in addition to the request for revision of the monthly report makes it possible to avoid extra processing delays. Furthermore, it is important to provide in the request for review the amounts corresponding to the correction of hours requested so that the salary, vacations and paid statutory holidays, and union dues are also corrected.

Addition of hours

If the request for review involves an addition to the hours declared in the monthly report, the employer must calculate the remittances and contributions corresponding to the change requested. It must then pay the amount by one or another of the following payment methods:

- By cheque, indicating the employer number and the period for the amended monthly report

- By electronic payment, separate from any payment for the monthly report in the current period

- In cash or by debit card, by going to a CCQ Customer Service counter

Please note that payments regarding a review of a monthly report cannot be made by preauthorized debit. Employers must therefore use one of the methods given above. By making the payment at the time the request for review of the monthly report is made, it is possible to avoid extra delays in processing the file.

Employer’s obligations regarding the hour reserve

For the light and heavy residential sectors, under Article 21.03 o) of the collective agreement for the residential sector, employers must report the details of the hour reserve on the pay slips of their employees, including:

- Hours debited

- Hours credited

- The balance of hours

-

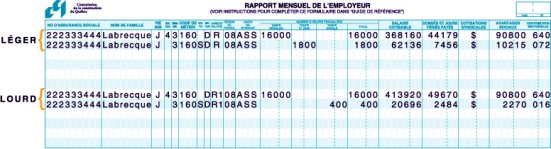

To report the liquidation of the hour reserve

The hour reserve is liquidated every year at the end of the averaging and reference period. The hours are liquidated and must be declared on a separate line of the monthly report. The employer must use status code S and specify wage schedule R for the light residential sector and R-1 for the heavy residential sector. The contributions and dues associated with the liquidated hours must be recorded in the monthly report, and the corresponding amounts must be paid.

Example:

For the light residential sector: The liquidated hours must be reported at the wage rate plus 50% (time and a half) and recorded in the “Temps et demi” column.

For the heavy residential sector: The liquidated hours must be reported at the wage rate plus 100% (double time) and recorded in the “Temps double” column.

-

Change to R and S statuses

Liquidation of the hour reserve and use of the R and S statuses

As part of its digital shift, the Commission de la construction du Québec (CCQ) will modernize the monthly report to make management simpler.

Following the regulatory and administrative amendments adopted by the government and made public in summer 2023, in several months the R and S statuses in the monthly report will change in the modernized monthly report.

New procedure to implement immediately

As usual, the employer must liquidate the hours recorded in status R by using status S, before April 30, 2025. The clause in the collective agreement will still apply, but soon the hours will no longer be tracked in the monthly report.

As of March 30, 2025, these hours will have to continue to be recorded in the employer’s register, and from then on the hours will be declared in the regular status at time of payment.

Employees may continue to track their hours through their pay slips, as provided for in the collective agreement, and record them on their own.

More information

- Website of the Association des professionnels de la construction et de l'habitation du Québec (APCHQ)

- Labour relations consultants of the APCHQ: 1 800 463-6142

- CCQ employer line: 1 877 973-5383